22 May The Cruel Irony of Poverty

By: John Arruda

It’s expensive to live in poverty.

Think about that sentence for a moment. It doesn’t seem logical, but when you start putting yourself in the shoes of someone who’s struggling with money, it soon becomes very clear and very true.

Consider housing. If you can’t afford first and last month’s rent for an apartment, your only option may be an overpriced residential motel.

These motels have the bare minimum in necessities, like kitchenettes that aren’t meant for making proper meals. This, in turn, drives you towards buying expensive meals instead of making your own or skipping meals and risking expensive medical complications.

Then there’s transportation. Without a vehicle, you may have to rely on cabs. If you do have a vehicle, it may be old and unreliable, making it more costly to maintain, fuel and repair.

A two-kilometre drive to the grocery store will cost most drivers, based on 6L per 100km and $1.30 in gas, approximately $0.16 in gas each way. The same taxi ride would cost $8.35 each way.

That’s more than 52 times the cost for the same trip.

Now picture that for every trip that you make. What would you have to sacrifice to stop yourself from going further into debt?

The alternative is owning your own car. Unfortunately, poverty can make it so that car loans are out of reach for you. Even if you can get a car, loan payments, insurance, gas, maintenance and other fees can cost more than what many people living in poverty earn in a month.

If it’s hard to get to a supermarket, you’ll pay more at a convenience store for essentials like soap and toilet paper.

Most staple foods can cost anywhere from 10-54% more at a convenience store than a supermarket. But getting to supermarkets and grocery stores might be too expensive or too far to walk for someone who doesn’t have reliable transportation.

Without a kitchen or refrigerator, you’ll be more likely to choose fast food, which is pricey and provides much less nutrition.

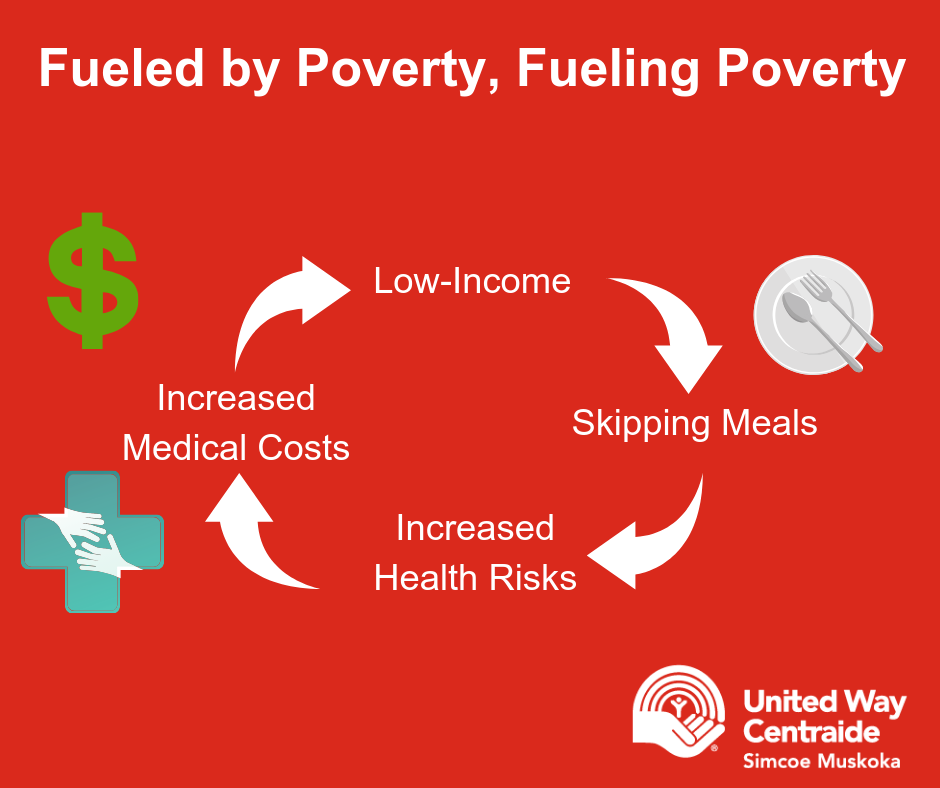

Food insecurity is one of the most devastating facets of poverty. It means skipping meals to keep the lights on or pay the rent. It means choosing fast food because you don’t have a place to store produce. It leads to increased medical costs and has long-term health effects, which entrench you deeper into poverty.

If you need to borrow, your only option is usually a payday loan company where you’ll end up paying a much higher interest rate.

The further into poverty someone gets, the worse their credit becomes. This makes borrowing from secure, low-interest lenders like banks all but impossible and payday loans one of the only options. The difference in costs between the two loans just buries you in poverty even further.

A payday loan company can charge an annual percentage rate (APR) of over 180% over a 30-day loan and up to 780% over a 7-day loan. This is vastly different compared to bank loans and credit cards, which have APRs ranging from 5-25%, thanks to longer repayment times and better interest rates.

All these higher prices mean those who live in poverty may face additional challenges that those above the poverty line do not. It makes emerging from poverty even more difficult, if not impossible.

United Way Simcoe Muskoka is working hard to make sure no one faces poverty alone. Poverty is a problem that affects all of us, in every community, and we are working with our community partners to make sure that we can do as much as possible to help break the cycle of poverty.

To stay up to date on how United Way Simcoe Muskoka is making a difference in our communities, be sure to subscribe to our newsletter. Follow us on Facebook, Twitter and Instagram, too!

Please note that any figures or numbers not linked in the above article were taken directly from local businesses and stores.

John Arruda is a media professional and community volunteer. UWSM is very thankful for John’s blog!

Sorry, the comment form is closed at this time.