07 Dec Don’t forget the deadline!

There are many benefits of making a donation to charity.

This time of year, it can be pretty easy to see the need in our community and empathize with families who will go without a holiday feast (or even adequate food on their table), parents who’d like to see their children’s smiles when receiving a new toy, and individuals living rough without enough clothing to bundle up against the cold.

At United Way Simcoe Muskoka, we work year-round to create pathways out of poverty so those struggling today will have a brighter future, and so the generations that follow won’t have to struggle at all.

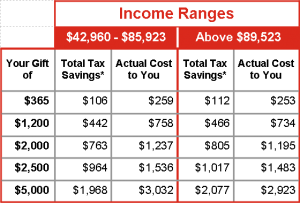

But in addition to helping change local lives, a donation to our Community Fund means a federal tax credit against your income tax equal to 15% on the first $200 donation, and 29% on the amount exceeding $200. Taxable incomes above $200K may receive 33% on the portion above $200.

This table (based on 2018 personal tax rates, with amounts rounded to the nearest dollar) is an example of potential tax savings, as it uses averages within the ranges. Overall savings are dependent on individual situations. Consult your tax specialist to determine your personal savings.

Don’t miss the deadline, make your UWSM donation now.

Donating publicly traded securities – the benefits are clear.

The Capital Gains Tax was removed from publicly traded shares that are donated. This means that you receive a tax receipt for the full value of the shares, but are not taxed on any gain. A minimum of $1,200 of the total gift must remain with United Way.

How to maximizing the tax benefit of your charitable giving…

If you sell a security, you pay tax on 50% of the capital gain. HOWEVER —

when you donate a Gift of Security to UWSM, the taxable gain is completely eliminated.

You will also receive a tax receipt for the full market value of the security in the amount of the closing trading price on the day UWSM received the security.

*Table examples use an Ontario federal/provincial combined tax rate for incomes greater than $100K/yr. Individual situations will vary. Consult your tax specialist to determine your personal savings.

Making a Gift of Securities is as easy as calling 705-726-2301, x2026.

Wondering if donating to UWSM is right for you? Read why Deborah, a long-time donor and recent addition to our volunteer Board of Directors chooses United Way.

Whatever your philanthropic priority or gift amount, don’t forget to ensure your annual donation arrives at its destination by December 31, 2018, so you get the added benefit of this year’s tax advantages.

Local giving. Local results.

#LocalLove

Sorry, the comment form is closed at this time.